Annuities and Income Solutions

Why Consider Annuity for Your Retirement?

Many people are surprised to learn that Social Security alone may not be enough to cover their retirement expenses. In fact, research shows that more than half of near-retirees believe they'll need more than twice what Social Security provides to live comfortably. That's where annuities—especially fixed and fixed index annuities—come in. These products can give you guaranteed income for life, helping fill the gap between what you have and what you'll need.

How an Annuity Works

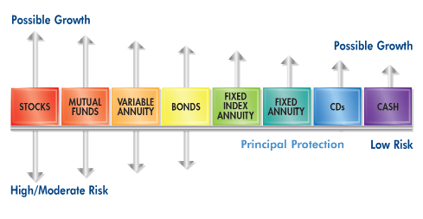

An annuity is a financial product from an insurance company that can provide steady, predictable income—no matter how long you live. With a fixed index annuity, your growth is tied to a market index, like the S&P 500, giving you the chance to earn more when the market does well, but with protection from losing money if the market drops. Many people use them to create a retirement “paycheck” they can count on.

Buying an Annuity

You can purchase an annuity through a licensed insurance agent, certain banks, or financial firms. Some agents work with one company, while independent agents can offer options from multiple providers. A knowledgeable professional will explain how the product works, its fees, tax advantages, and any withdrawal rules so you can make the best choice for your needs.

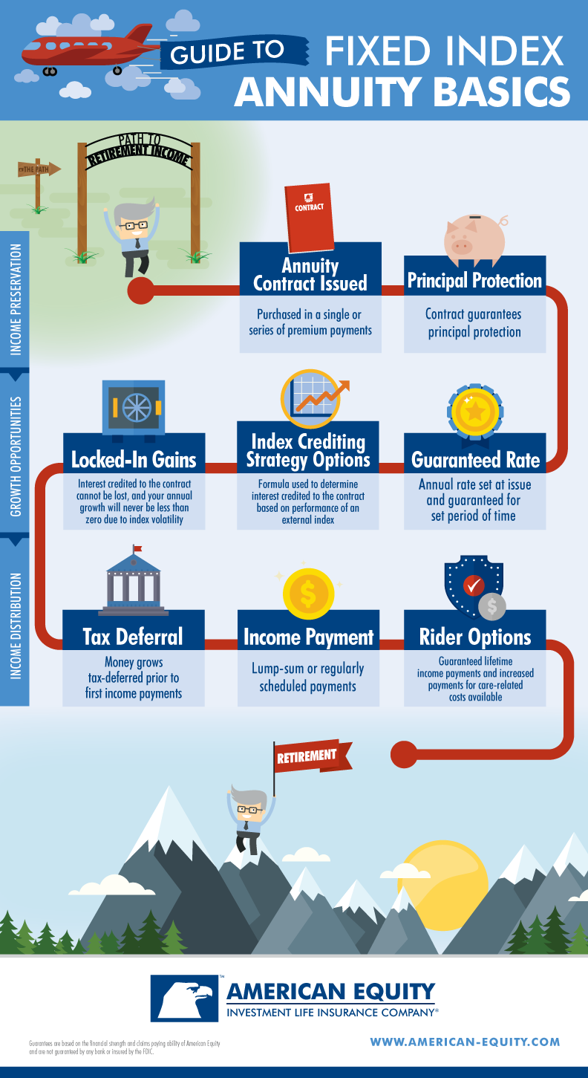

FIXED INDEX ANNUITY

A fixed index annuity is a retirement product that offers a mix of benefits like growth linked to a market index, protection of your principal, tax-deferred growth, and guaranteed income—sometimes for life. It’s designed to help you grow your savings while protecting your money from market losses, giving you a steady income you can rely on during retirement.

Fixed index annuities also offer flexibility, letting you choose from different index strategies to grow your money, access a portion of your funds when needed, and potentially pass on assets to your loved ones without probate. Many people use them to balance their retirement portfolios and achieve long-term financial security.

Contact Us

THE COMMITMENT OF A FIXED ANNUITY

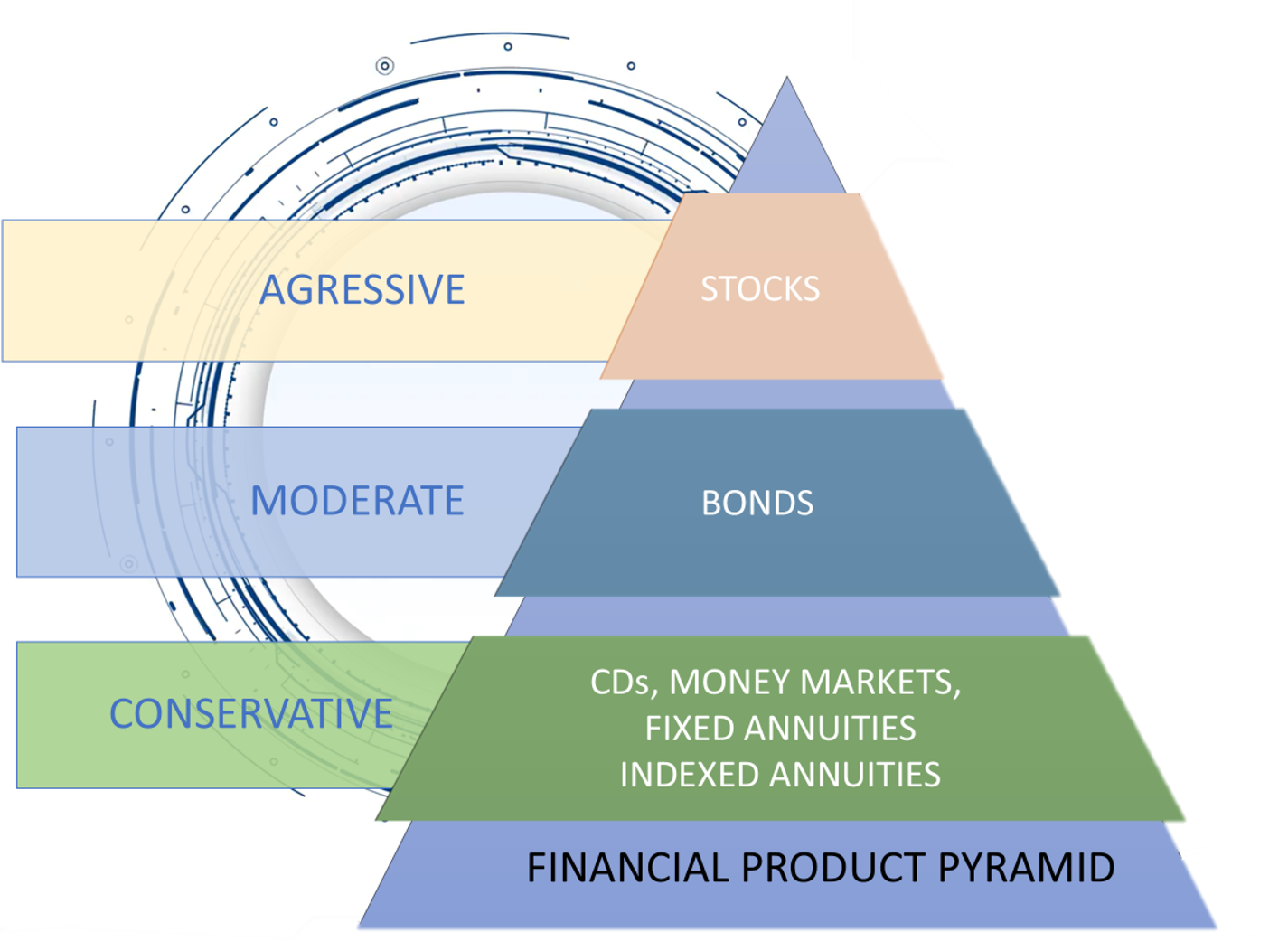

Planning a secure retirement takes dedication, and you deserve confidence that your money is protected from market ups and downs. Fixed annuities offer financial solutions like protecting your principal, providing access to funds when needed, tax advantages, and helping care for your loved ones.

A fixed annuity is a contract with an insurance company where your money earns interest at a fixed rate set at the start and guaranteed for a specific time. These annuities often include features such as a guaranteed interest rate, flexible access for healthcare expenses through special riders, and options to convert your savings into guaranteed lifetime income payments.

Fixed annuities provide principal protection, tax-deferred growth, and a steady income stream, making them a trusted choice for long-term retirement planning. American Equity offers a variety of fixed annuity products designed to meet different needs and goals.

Contact UsIMMEDIATE AND DEFERRED ANNUITIES

An IMMEDIATE ANNUITY is a contract between you and an insurance company where you make a one-time payment, and income payments begin within 12 months. You can choose to receive guaranteed income for life or for a fixed period (from 5 to 25 years). With several payout options available, you can pick a plan that best fits your retirement goals and needs.

A DEFERRED ANNUITY is a retirement savings product where you put money in now, and the payments start at a future date—often when you retire. Your money grows tax-deferred during the saving period, meaning you don’t pay taxes on the earnings until you begin withdrawing. When the payout phase begins, you can receive regular income payments for a set time or for the rest of your life.

A Smart Addition to Your Plan

Annuities aren’t right for everyone, but they can be a great way to add security to your retirement income. They can ensure you won’t outlive your money, protect you from market losses, and give you peace of mind knowing you’ll have income for life. When combined with Social Security and other savings, an annuity can help you enjoy retirement with confidence.